Everything You Need to Know About Life Insurance Collateral Assignment

If you need a loan, your lender may ask you for collateral before approving your application for the loan. There are various options available to you when it comes to this asset, from a savings account to an employer-sponsored retirement plan. However, you may not know that life insurance plans can be used as collateral in specific instances. Indeed, among the most efficient collateral methods is a policy of life insurance.

Exactly What Is a Life Insurance Policy's "Collateral Assignment"?

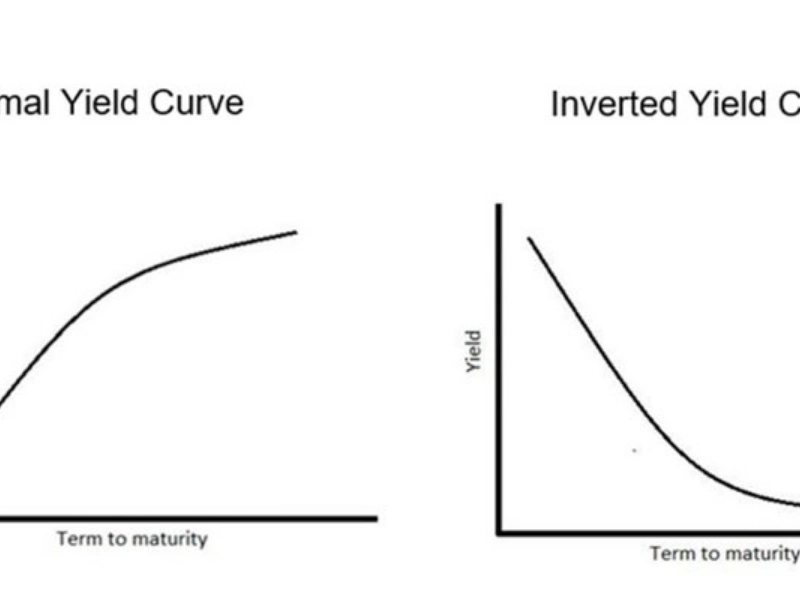

An insured can use their life insurance policy as security for a loan when they make a collateral assignment. If the insured person dies while a policy is still in effect, the sum assured would be used to repay the person's debt before their death. As long as the borrower is alive, the lender is confident that they'd be reimbursed. Because of its economic value, continuous insurance policies are often used as collateral for loans. As long as the insured remains alive, term life insurance has no intrinsic worth that it may use to repay debts. After all policy debts and charges have been paid back, the insured can cash in their permanent policy if they cannot make their payments any longer.

How Do I Apply For Collateral Assignment Life Insurance?

The Process of Completing a Task

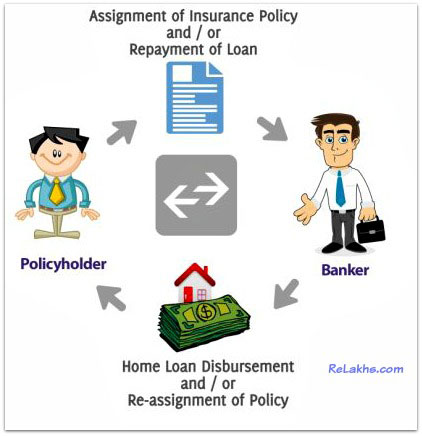

Because the lender would receive a portion of your life insurance even though you have previously paid off the debt, you cannot use your life insurance payout as collateral. Instead, it would be best to name the lender as an alternate beneficiary. Instead, you will function as the assignor and list the creditor as an assignment on the insurance. To use policy as collateral, you must first acquire the go-ahead from your life health insurer, which will furnish you with the proper papers. Once you have that, the lender can proceed with the underwriting procedure. Then your loan application will either be accepted or rejected by the financial institution. It's important to keep in mind that neither the borrower nor the lender is required by law to arrange an assignment using a standard set of paperwork. The underwriter does not have to authorize this sort of assignment, which can be created by one or both parties and the organization.

Policies Currently In Place Versus Those That will Be Implemented In the Future

Some lenders will accept an existing policy as collateral, while others may insist on your purchasing a new policy specifically for this use. The insurance provider will need to know if you intend to use the policy as collateral. Suppose you pay the loan back, who will only compensate the creditor from the policy's current value under the terms of a collateral assignment, which is a limited transfer under the law.

How Do You Identify Your Beneficiaries When Applying For Collateral Assignment Life Insurance?

The beneficiaries should be the same as they would be if the policy had not been collateralized. For example, if you want your children to receive life insurance from your life insurance policy, you would designate them equal co-beneficiaries. Upon your death, the assignee of your loan will receive the remaining death benefit and distribute it by your final wishes if you have not paid it back in full.

The beneficiaries should be the same as they would be if the policy had not been collateralized. For example, if you want your children to receive life insurance from your life insurance policy, you would designate them equal co-beneficiaries. Upon your death, the assignee of your loan will receive the remaining death benefit and distribute it by your final wishes if you have not paid it back in full.

Collateral Assignment Life Insurance Is Owned By Whom?

In a collateral assignment, the policy's owner must always be you. The policy must have both of you named co-assignors if you and the husband own it jointly. To ensure that your collateral doesn't expire, you must make the subscription payments on time. Most lenders demand you provide them copies of insurance company accounts and other notices so that you can inform them if you've missed a payment or the policy is in danger of being terminated. For a short time, the creditor may take steps to make the premiums for you, but these payments are normally added to the amount owed on your loan.